pa estate tax exemption

The federal estate tax exemption is 1170 million in 2021 and 1206 million in 2022. Posted in Real Estate Taxes.

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

The Disabled Veterans Tax Exemption provides real estate tax exemption for any honorably discharged veteran who is 100 disabled is a resident of the Commonwealth of Pennsylvania and has a financial need.

. I understand that this verification is made subject to the penalties of 18 Pa CSA. The probate process might require a tax return filed but the end result will be no tax due if the entire estate passes to only exempt beneficiaries. Ad Download or Email PA REV-1737-1 More Fillable Forms Register and Subscribe Now.

Nonprofit entities that own Pennsylvania real property are under relentless attack from local taxing jurisdictions regarding the exempt status of property used for charitable purposes and thus must be ever. Dwelling is owned solely by the veteran or veteranspouse. Eligible candidates for the program must meet the following criteria.

The rates for Pennsylvania inheritance tax are as follows. Penalties including fines and imprisonment for making false statements on official forms such as this Application for Exemption from Real Property Taxes. To provide real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has financial need.

A qualified disabled veteran or unmarried surviving spouse shall be exempt from real property taxes that become due on or after the date the applicant first files a written request for an exemption with the appropriate Board for the Assessment and Revision of Taxes or similar board. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Their incomes are under 30000.

Property tax reduction will be through a homestead or farmstead exclusion. The Homestead Exemption reduces the taxable portion of your propertys assessed value. E Busines to the bus et of family rty or for l estate w mption th e of the de the owners he business death.

Transfers to grandparents parents descendants which. The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or income to take up to 3500 from the decedents bank account until the estate account is opened. Real Estate Tax Exemption Pre-Screening Form.

Most homeowners will save 629 a year on their Real Estate Tax bill. 2 No part of the organizations net income can inure to the direct benefit of any individual. 4904 pertaining to unsworn.

Exception if the decedent is under age 21 Pennsylvania treats a son-in-law or daughter-in-law as if they are. While the majority of realty transfer tax is deposited into Pennsylvanias General Fund 15 percent of collections are dedicated to the Keystone Recreation Park and Conservation Fund. In an action in which taxpayers presented constitutional challenges to the imposition of a tax at the 1 rate established by the Pennsylvania Realty Transfer Tax Act within the context of a real estate transfer in which one party to the transaction is exempt the Act did not discriminate against parties dealing with the Federal government in violation of the Federal supremacy.

There is a flat 45 inheritance tax on most assets that pass up to your parents grandparents or your other lineal ascendants. Surviving spouses charities and transfers to the government are exempt from the Pennsylvania Inheritance Tax. In the event there is no spouse or child the exemption may be claimed by a.

2 No part of the organizations net income can inure to the direct benefit of any individual. 1 Organization must be tax-exempt under the Internal Revenue Code. No estate will have to pay estate tax from Pennsylvania.

In order to qualify for the tax exemption certain qualifications need to be met. With this exemption the assessed value of the property is reduced by 45000. Once we accept your application you never have to reapply for the exemption.

13 rows Federal Estate Tax. How much is the homestead exemption in PA. The estate tax is a tax on an individuals right to transfer property upon your death.

Senior households from other parts of Pennsylvania can get an increase in their property tax rebate by 50 if. Pennsylvania Department of Revenue Tax Types Sales Use and Hotel Occupancy Tax Non-Profit Begin Main Content Area Page Content. 3 The organizations conduct must be primarily supported by government grants or contracts funds solicited from its own membership congregation or previous donors and.

By Paul Morcom on October 16 2018. Update on Pennsylvanias Real Estate Tax Purely Public Charity Exemption and PILOTs. 45 percent on transfers to direct descendants and lineal heirs.

At death a persons assets are frozen until the Executor goes to the Register of Wills with the. The estate and gift tax exemption is 1158 million per. Deeds to burial sites certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax.

You can learn more from the PA Department of Military and Veterans Affairs. Ad Download Or Email REV-1220 AS More Fillable Forms Try for Free Now. Philadelphia Scranton or Pittsburgh senior households with incomes of less than 30000 can get an increase in their property tax rebate by 50.

12 percent on transfers to. Must be a resident of the Commonwealth. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021.

They pay more than 15 of income in property taxes. And to find the amount due the fair market values of all the decedents assets as of death are added up. 1 Organization must be tax-exempt under.

1 Any funds after. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. Ad Download Or Email PA REV-72 More Fillable Forms Register and Subscribe Now.

Real property tax exemptions shall be effective as follows. A farmstead is defined as all buildings and structures on a farm not less than ten contiguous acres in area not otherwise exempt from real property taxation or qualified for any other abatement or exclusion pursuant to any other law that are used primarily to produce or store any farm product produced on the farm for purposes of commercial agricultural production to. TAX 2012 2 modities ricultural U e following Estate Tax imal produ ercial purp land less r improvem ands used uty and op inatory ba e of produ ting the re ursuant to deral agen tocked by products.

Sign in to Save Progress. The total income from Line 9 of the pro-forma PA-40 Personal Income Tax Return and any nontaxable income allocated to the bankruptcy estate that would be eligibility income for Tax Forgiveness on PA-40 Schedule SP are also included as eligibility income on Part C Line 10 Cash received for personal purposes from outside your home of PA-40 Schedule SP. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural culture and family farms intact for future generations.

If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim the exemption.

Pennsylvania Tax Form 592 Free Templates In Pdf Word Excel Download

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Tax Form 592 Free Templates In Pdf Word Excel Download

Estate Gift Tax Considerations

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Recent Changes To Estate Tax Law What S New For 2019

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

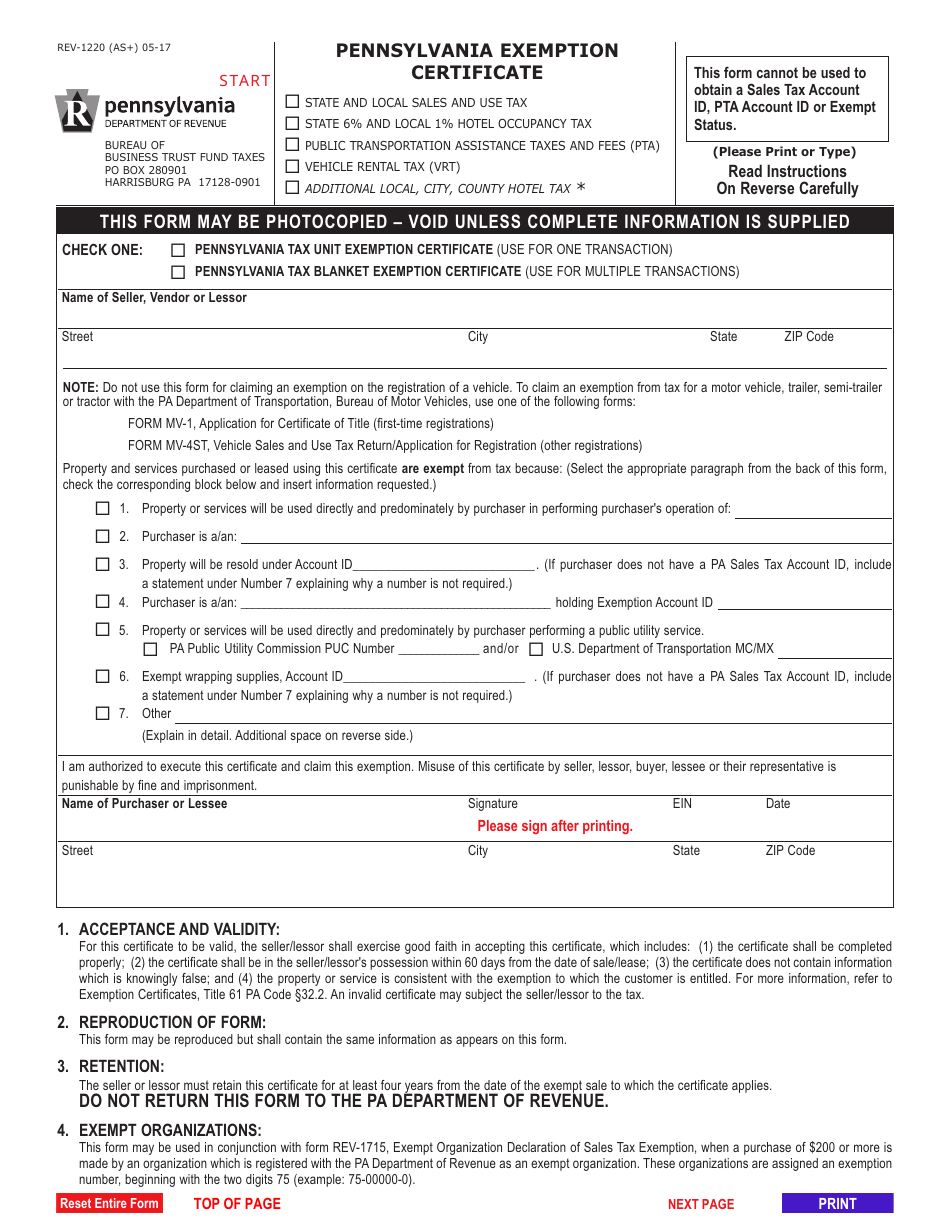

Form Rev 1220 As Download Fillable Pdf Or Fill Online Pennsylvania Exemption Certificate Pennsylvania Templateroller

61 Pa Code Chapter 31 Imposition

New York S Death Tax The Case For Killing It Empire Center For Public Policy

61 Pa Code Chapter 31 Imposition

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How Do State Estate And Inheritance Taxes Work Tax Policy Center