utah state tax commission tap

You are being redirected to the TAP home page. On TAP Presented by Utah State Tax Commission.

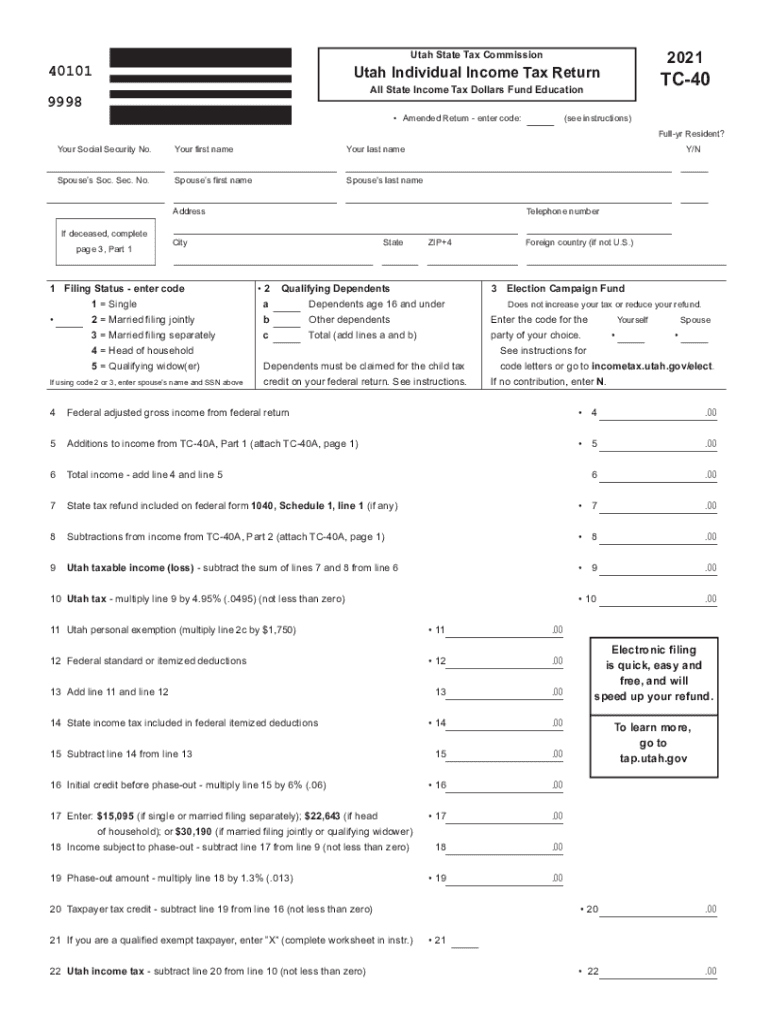

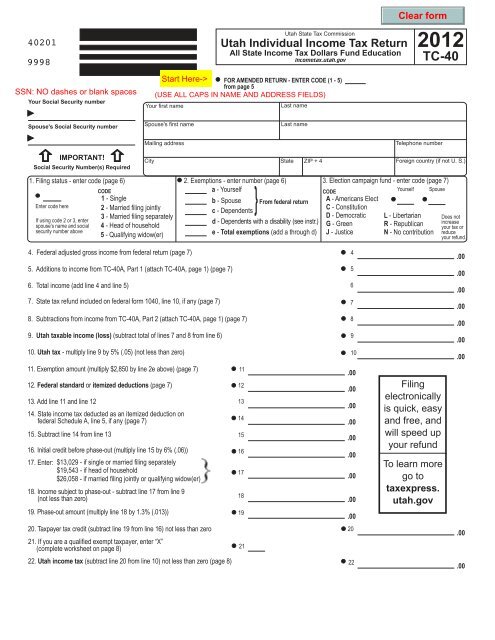

Download Instruction For Tc 40 Utah Individual Income Tax Return Pdf 2020 Templateroller

Taxpayer Access Point TAP.

. Tax Instruction. The letter will direct you to take the quiz on our secure website at taputahgov. What should I do.

Filing Utah State Taxes. Is scheduled send a request to cancel the payment to TAPSupportutahgov. Choose any of these for more information.

If you cant access your TAP account with the Forgot Username. Sales Tax Exemption Certificate Utah Simple Online Application. Utah State Tax Commission Tap.

Ad Sales Tax Exemption Certificate Utah Wholesale License Reseller Permit Businesses Registration. Mail your payment coupon and Utah return to. Utah State Tax Commission SFG PO Box.

TAP Taxpayer Access Point at taputahgov. Click Here to Start Over. I cant access my TAP account and cant answer the secret question to reset my TAP account.

Options you must register for a new TAP account. Payment coupons are available for most tax types on the forms page. This unit trained in the detection of tax fraud receives information from the Tax Commissions Auditing Division and other sources and determines whether underpayments of tax may constitute a pattern of criminal fraud.

Your online session will timeout after 60 minutes of inactivity. Free Federal and State Tax Filing Sources. Pay the IRS Less Without Going to.

There are many free filing options available even for taxpayers with higher incomes. Has already cleared your bank account contact Taxpayer Services at 801-297-7705. Shows Submitted in TAP click your payment link then Cancel.

Motor Vehicle Enforcement MVED. Your session has expired. The Utah State Tax Commissions free.

The Tax Commission is not liable for cash lost in the mail. Motor Vehicles DMV. The Utah State Tax Commission has a criminal investigation unit to prosecute those who willfully evade Utahs tax laws.

Frequently asked questions about Taxpayer Access Point. Sales. Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0266.

Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content. Your online session will timeout after 60 minutes of inactivity. TAP will total tax due for you.

Enter sales of electricity heat gas coal fuel oil and other fuels sold for residential use included in line 7. If filing a paper return allow at least 90 days for your return to be processed. Tax Instruction.

The Tax Commission cannot issue a refund prior to March 1 unless we have received both your return and your employers required return. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Save your work if you will be away from your computer.

TAP will calculate the credit by multiplying the amount of these sales by the rate in effect as of your filing period. Has already cleared your bank account contact Taxpayer Services at 801-297-7705. TAP will be down for maintenance starting Friday March 11th at 5pm MDT.

Motor Vehicle Enforcement MVED. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. Residential fuels included in line 7.

Tap help for sales taxes tap help for withholding. It does not contain all tax laws or rules. Pay the IRS.

For security reasons TAP and other e-services are not available in most countries outside the United States. If you are mailing a check or money order please write in your account number and filing period or use a payment coupon. Still shows Pending in TAP click your payment link and Withdraw.

Due to our efforts to protect your identity please allow 120 days from the date you filed your return or 120 days from March 1 whichever is later to process your return and refund request. If you have not registered for a sales and use tax account you must do so before filing. You have been successfully.

Official tax information for the State of Utah. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Identity verification questions are based on information from your drivers license or state ID card and your Utah income tax returns for the previous one or two years if you had Utah tax returns for those years.

Taxpayer Access Point TAP. Sales. If you dont have the information you must register for a new TAP using your contact information.

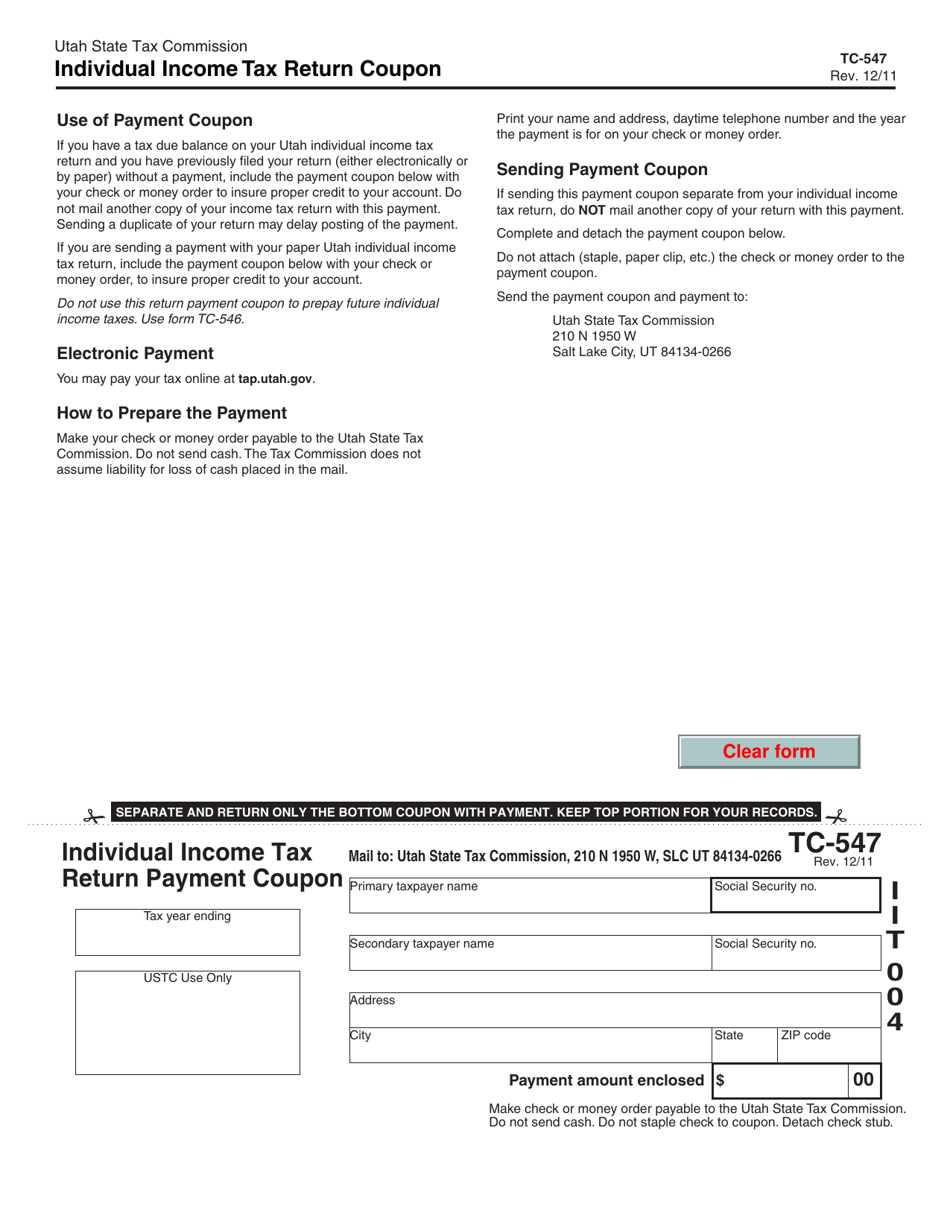

Include the TC-547 coupon with your payment. Taxpayers can close Outlets other locations Add additional new outlets. SALES TAX ACCOUNT UTAH STATE TAX COMMISSION SALES TAX 210 N 1950 W SLC LIT 84134-0400 Group Payment Coupon for Sales Tax Returns Indicate amount paid for each type.

Things to Know Credit Karma Tax - Official information about taxes administered in the state of utah by the utah state tax commission. Utah Taxpayer Access Point TAP TAP. Official tax information for the State of Utah.

If you are not redirected to the TAP home page within 10 seconds please click the button below.

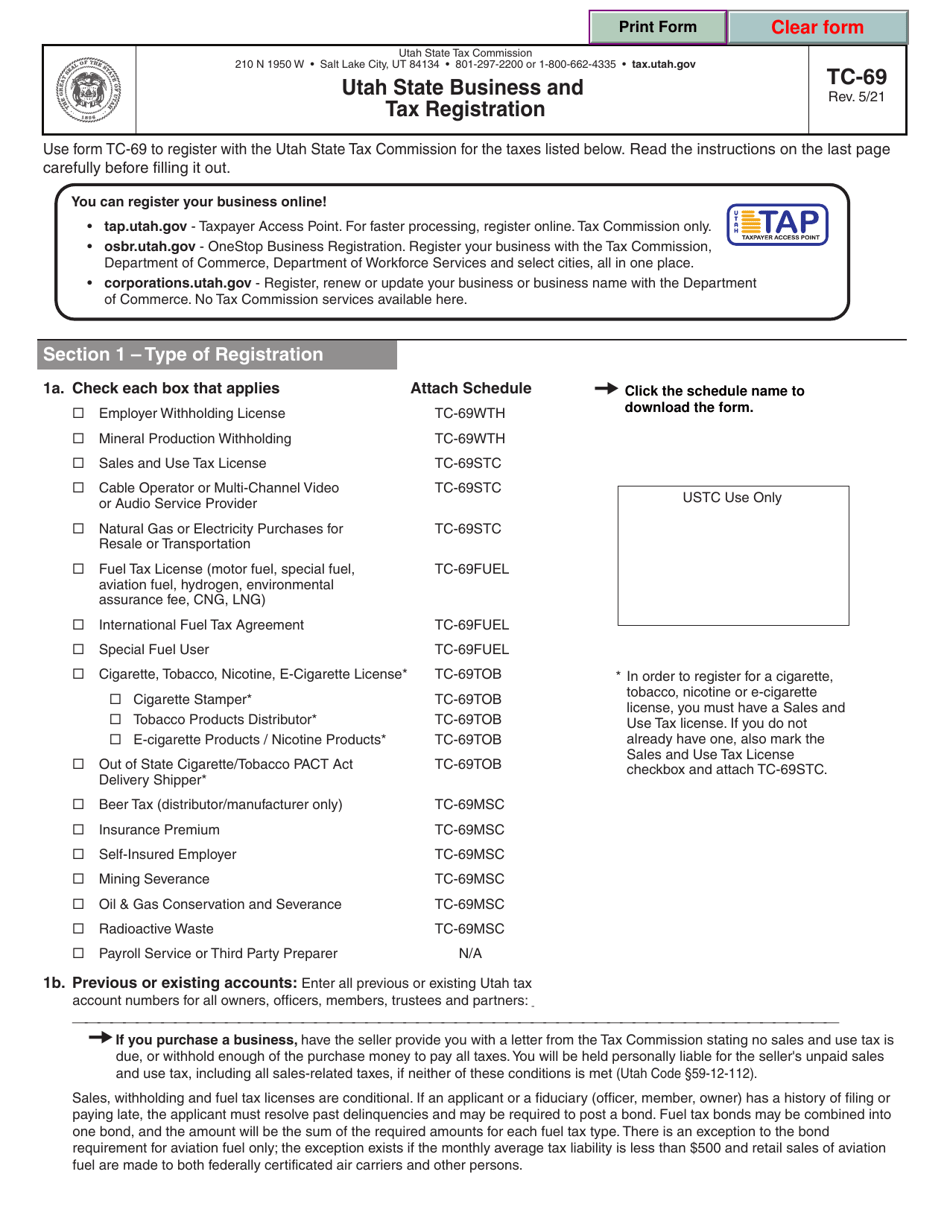

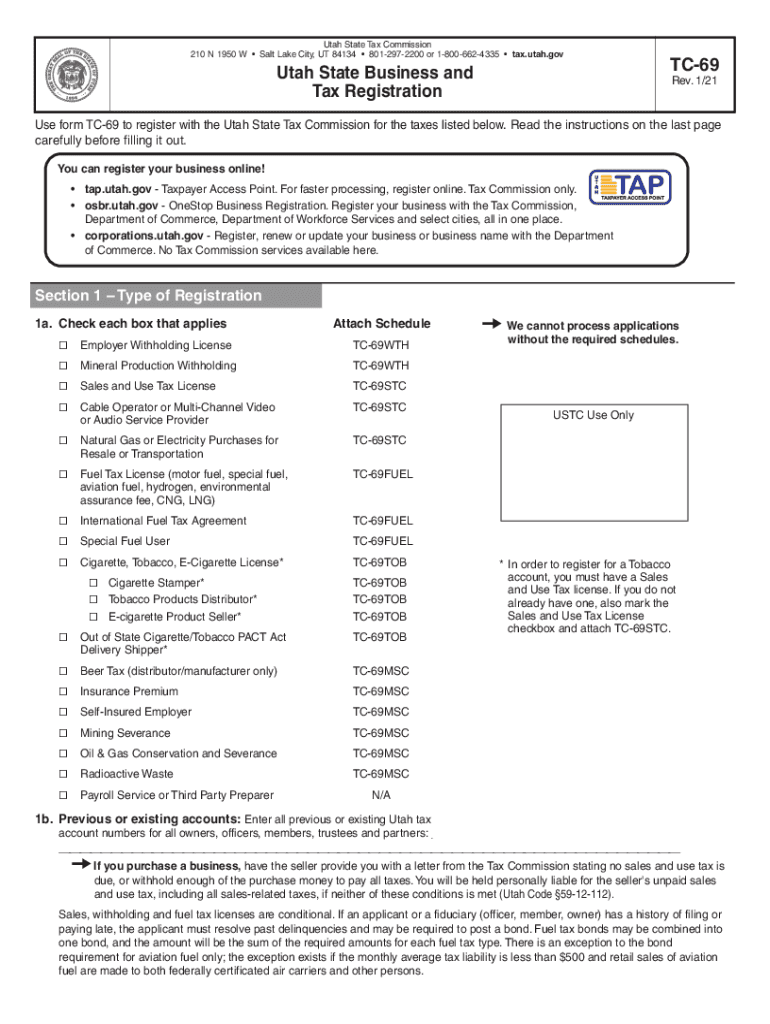

Form Tc 69 Download Fillable Pdf Or Fill Online Utah State Business And Tax Registration Utah Templateroller

Still Waiting For Your State Income Tax Refund Something Is Probably Wrong

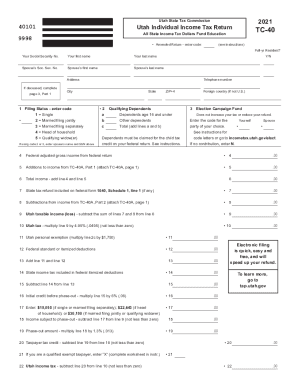

2021 Form Ut Tc 40 Fill Online Printable Fillable Blank Pdffiller

Utah State Tax Commission Official Website

Utah State Tax Commission Official Website

Ut Tc 69 2021 2022 Fill Out Tax Template Online Us Legal Forms

What You Need To Know Before Filing Utah State Tax Return

2021 Form Ut Tc 40 Fill Online Printable Fillable Blank Pdffiller

Form Tc 547 Download Fillable Pdf Or Fill Online Individual Income Tax Return Payment Coupon Utah Templateroller

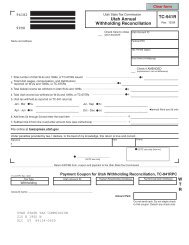

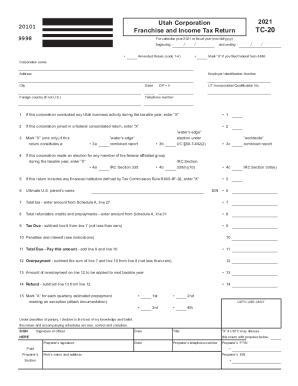

Tc 941 Utah Withholding Return Utah State Tax Commission

Form Tc 40 Utah State Tax Commission Utah Gov

2021 Form Ut Tc 40 Fill Online Printable Fillable Blank Pdffiller